Buying or selling a property in the UK is one of the most painful and frustrating experiences the majority of adults voluntarily put themselves through. Although I love property as an investment, I’ve always considered this transactional torment to be one of its biggest drawbacks.

In fact though, for investors it could be one of its biggest advantages – by protecting them from themselves…

The illiquidity of property

“Liquidity” means the ability to turn an asset or investment into cash.

An investment in the stock market, or bonds, or precious metals, or commodities, is (for the most part) highly liquid. If I owned a share in AstraZeneca, I could go online and immediately see the exact price I’d get if I sold it right now. A few taps on an app later, and I could have sold it and have the cash in my account.

In other words, shares have price transparency and you can sell quickly. A buy-to-let property couldn’t be more different on both of these features.

Lack of price transparency

What price could you get if you sold one of your buy-to-let properties today?

There are various ways you could try to get to an answer:

- Look at a portal like Rightmove to see what similar properties are selling for locally

- Look at Land Registry data to see what similar properties have actually sold for in the recent past

- Find some data for what prices in the area have done on average since you bought it, and apply that percentage increase to the price you paid

- Use an automated valuation tool like the one supplied by Zoopla and see what the algorithm comes up with

- Put it on the market with an estate agent and see what offers you get

- Put it into auction and see what price it achieves in the room

- Get a professional valuer to give you an opinion

The only methods that will give you an accurate answer to how much you could get for your property are putting the property with an estate agent or into auction – because you literally are selling the property.

Every other method will be an estimate, and each will give you a different answer. In fact, you’d probably get the most reliable answer by doing all of them and taking an average.

Even after doing all that, you still won’t know for sure what you’ll walk away with until you actually sell. That’s completely different from a share, where you can see a price instantly and know with certainty that it’s the price you’ll actually get.

Speed of sale

If you desperately wanted to offload a property, the absolute fastest you could do it would be in a couple of weeks – but this would involve selling to a specialist buyer who would expect a significant discount for moving quickly.

At auction, it might take a couple of months: a month for the next auction date to roll around, then 28 days for the buyer to complete legals.

On the open market, you could expect it to take at least a few months – and a year or more is by no means unheard of.

Again, this is worlds away from shares – where a sale is near-enough instant.

And this is a GOOD thing?

As I said, I’d always thought of this illiquidity as a drawback. But it might not be – because the easier it is to trade, the more likely you are to do it. And an abundance of evidence shows that most of the time – especially in times of market turmoil – the best thing for investors to do is nothing.

Study after study shows that the more people trade, the worse their performance is. Given the chance, most people will panic and sell their assets after prices have gone down, and be too fearful to buy back in until prices have gone up again.

With property, you can’t do this – and you don’t have the motivation to either:

- Has the value of your property gone down in the last week? Who knows! Unlike shares which update prices every second, you never get accurate pricing data for an individual property (until you sell) and even national and local averages are only updated once per month.

- Are you feeling nervy because of something in the news and think selling might be a good idea? Well, you have to be nervy enough to go through all manner of hassle to market your property, then have that nerviness persist for the months it takes for the sale to go through.

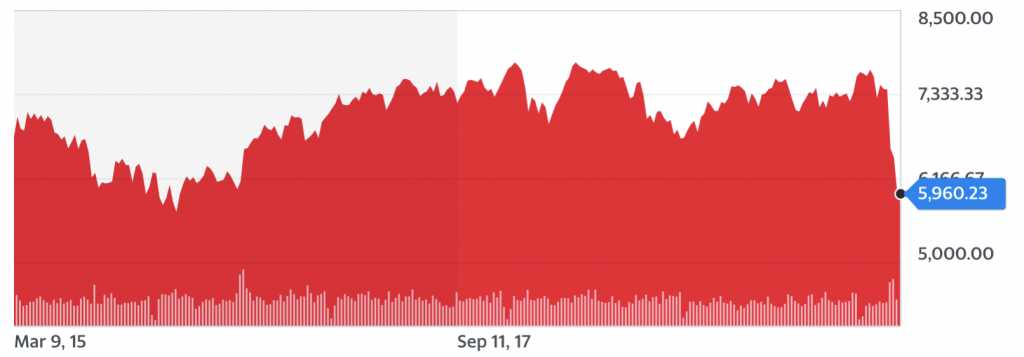

These two factors are why last the last five years of the FTSE100 looks like this:

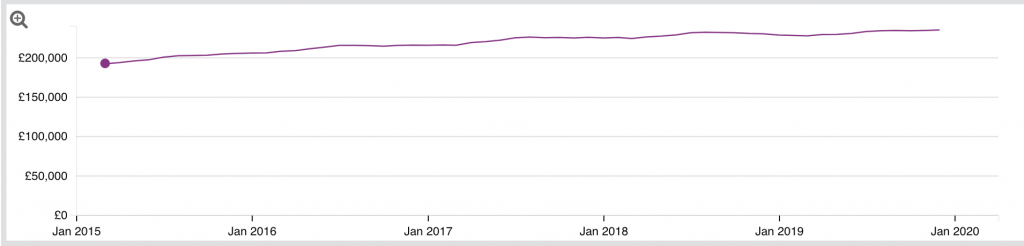

And the average UK property price over the last five years looks like this:

Does this mean that property is inherently less volatile than shares? Well, partially yes. But there’s also a volatility-smoothing behavioural feedback loop at work:

- We can’t see whatever day-to-day volatility there is, because we see pricing monthly at best (and it’s never specific to the individual property we own).

- That lack of visibility in itself reduces volatility, because it prevents market participants from taking emotionally driven daily actions.

Questions to ask yourself

You might not be buying into my line of argument here (or you might have fallen asleep), but some quick thought experiments should help:

- Data shows that property prices have just started falling and the outlook isn’t looking good. Would you sell one or more of your properties if you could just snap your fingers and have it done?

- The stock market has just dropped 10%. If you could sell a fraction of the equity in your property to protect yourself if property prices followed, would you do it?

- The stock market has just dropped 5%, you own a large amount of shares and you’re nervous about the future of the economy. If selling your shares would take six months and you weren’t sure what price you’d get at the end (if you could find a buyer at all), would you do it?

If you’re honest with yourself, you’ll probably find that in the first two scenarios, you’d have been biased towards action. The situation has changed, and you feel a compulsion to do something about it. In hindsight, would that have been the right thing to do? Sometimes yes, but usually not – given that property prices move relentlessly upward over the long term.

In the last scenario, you’d probably do nothing. And again, over the long term, nothing would most likely be the right thing to do – because even if prices fell another 15%, would you really have the confidence to buy back in again before they got back to where they are now?

Property: Psychologically the best investment

You can argue forever about whether property is a better investment than shares. You can pull out endless data to prove points one way or the other. But psychologically, property wins hands-down.

For a start, property actually gets people investing. It’s easy to understand. It’s not intimidating. It’s aspirational. It’s fun (for the most part). So you’ll make sacrifices to save up to buy your next property which you just wouldn’t do to add to your stock market portfolio.

Then once you’ve invested, property saves you from yourself by making it really bloody hard to do anything. And however much of an investment genius and economic sage you think you are, the reality is that just doing nothing – for years on end, come what may – is usually the best thing you can possibly do.